Artists in Control: Sui Blockchain’s Answer to Royalty Protection and Digital Ownership

Authors: Andreas Xydas (Twitter, Linkedin), George Sextos (Twitter, Linkedin)

In this article, we explore how blockchain technology is transforming opportunities for artists by offering secure, automated royalty systems and new avenues for monetisation. We discuss the challenges artists face in ensuring fair compensation for their work and examine how Sui's innovative approach addresses these issues. From built-in royalty enforcement to flexible NFT standards, you'll learn why Sui stands out as an ideal blockchain for the creative community.

A New set of Opportunities for Artists with Blockchain

Blockchain technology has opened a new chapter for artists, providing them with tools to securely create and share art while maintaining control over their intellectual property. By minting art as NFTs, artists can authenticate their work, combat forgery, and earn royalties automatically from resales. These advancements are giving creators unprecedented opportunities to monetise their art, build stronger relationships with their audiences, and expand their reach in a global digital marketplace.

The Birth of NFTs: How It All Started

NFTs (Non-Fungible Tokens) first gained attention in 2017 with projects like CryptoPunks and CryptoKitties, which showcased the potential of blockchain for creating unique, collectible digital assets. Unlike traditional cryptocurrencies, NFTs are distinct in that each token represents a unique item, allowing for digital scarcity. These early projects helped introduce the idea that blockchain could be used to represent and trade digital art, collectibles, and more.

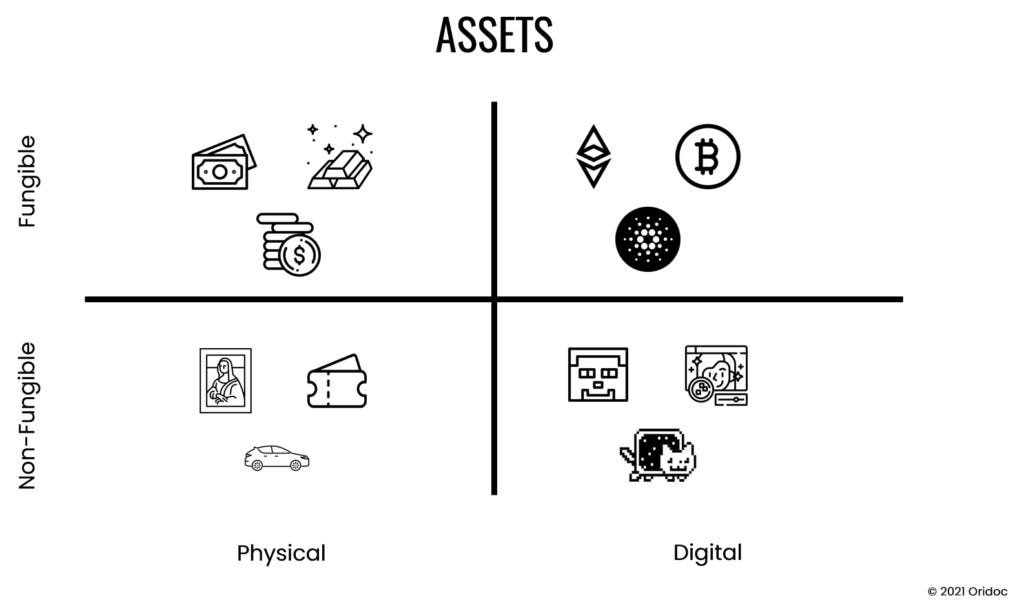

Fungible vs Non-fungible tokens

Think of dollars in your wallet. If you exchange one dollar bill for another, it doesn’t change anything for you because each dollar has the same value. That’s fungible: things that can be swapped without losing value or meaning. Fungible tokens, like cryptocurrencies (e.g. Bitcoin), work the same way, each token is identical to any other of its kind.

On the other hand, think of a concert ticket. Each ticket is unique because it’s tied to a specific seat, date, and performance. You can’t simply swap it for another ticket without changing the experience. This is non-fungible: each item is unique or has unique characteristics. Non-fungible tokens (NFTs) are digital assets that work the same way — each one represents something specific and unique, which can't be replaced by another.

The NFT Boom and Artistic Transformation

By 2020, NFTs had surged into the mainstream, with artists, musicians, and creators using them to sell digital art directly to collectors. Platforms like OpenSea and Rarible emerged, providing marketplaces where artists could reach a global audience. NFTs quickly became an avenue for artists to experiment with new forms of digital expression, ranging from interactive art pieces to audio-visual creations. This period marked a shift in how art was valued, as artists could now monetise digital work in ways previously impossible.

Unlocking New Revenue Streams

NFTs empower artists to reach global audiences directly without relying on traditional intermediaries. Each NFT carries its own identity on the blockchain, providing verifiable ownership and creating lasting value. Blockchain-based marketplaces enable artists to release their work independently, with control over pricing, distribution, and additional ownership perks. By adding "unlockable" content, artists can grant exclusive access to virtual meet-and-greets, behind-the-scenes material, or future art releases, deepening the connection between artists and fans.

Beyond Visual Art: NFTs in Music, Literature, Gaming, and More

While initially popular for visual art, NFTs have become a versatile tool across various media. Musicians offer fans exclusive tracks or concert experiences, authors create limited-edition digital books, and game developers enable players to own rare in-game assets. NFTs provide new ways to interact with and own digital content, enhancing fan engagement and providing creators with ongoing revenue. This cross-media application allows NFTs to broaden their impact, transforming digital ownership across entertainment and beyond.

The Power of Automated Royalties

One of the most transformative features of NFTs is the ability to program royalties automatically through smart contracts. Artists can specify a royalty percentage for each secondary sale, ensuring they continue to profit as their work gains value in the market. This automatic royalty mechanism is tamper-proof and enables artists to benefit from the ongoing demand for their creations, creating a sustainable income model that supports them throughout their careers.

The Royalty Crisis: Lessons from Ethereum

The promise of recurring income from royalties once positioned NFTs as a powerful solution for artists seeking sustainable revenue. However, this model faced challenges as certain platforms undermined its effectiveness. Notably, OpenSea, the largest NFT marketplace on Ethereum, decided to disable its on-chain royalty enforcement tool, the Operator Filter, after other marketplaces like Blur, Dew, and LooksRare found ways to bypass it. This decision left creators without revenue from secondary sales, revealing the vulnerability of relying on marketplace-dependent royalties and highlighting the need for robust, on-chain enforcement mechanisms.

How OpenSea’s Decision Impacted Artists

In an unexpected move, OpenSea decided to make royalties optional, allowing buyers to bypass paying creator fees. This decision was met with outrage from the creator community, as many artists had structured their income models around ongoing royalties from resales. Without this mechanism, artists lost a key revenue stream, as they could no longer depend on consistent earnings from the resale market. This policy shift forced creators to reconsider their reliance on traditional platforms and fuelled interest in decentralised, on-chain solutions that would be immune to marketplace policy changes.

For many artists, the decision had both financial and psychological consequences. Beyond the immediate loss of income, creators felt a breach of trust in the NFT ecosystem. The move underscored the need for an alternative approach where royalties could be enforced at the protocol level, ensuring artists are compensated for the enduring value of their work.

The Need for True On-Chain Royalties

The OpenSea incident revealed the limitations of relying on marketplaces for royalty enforcement, as well as the broader risks artists face when their income depends on third-party platforms. This controversy highlighted the importance of embedding royalties directly within blockchain protocols, making them immutable and enforceable regardless of marketplace policies. Artists began advocating for on-chain solutions that would empower them to retain control over their revenue model and reduce dependency on any one platform.

Why Sui Blockchain Offers Unique Advantages for Artists

Sui tackles the royalty challenges faced by artists through a powerful infrastructure that integrates royalty enforcement directly into the blockchain itself. Unlike traditional platforms where royalty enforcement relies on marketplaces, Sui provides a native solution through its Kiosk primitive and object-centric architecture. This ensures that royalties are enforced on-chain, protecting artists from policy changes by any marketplace. Additionally, Sui’s efficient performance and low transaction fees make it a prime choice for artists seeking a scalable, sustainable platform.

How Sui Enforces Royalties Through Innovative Primitives

Object-Centric Architecture & Kiosk Primitives

Sui’s object-centric architecture, combined with Kiosk primitives, creates a robust framework for trading NFTs in a way that enforces artist royalties. While NFTs are owned objects, placing them within a Kiosk — a shared-object primitive for listing and trading — allows users to interact with and purchase these assets. However, true control over royalties and trading permissions lies within the Transfer Policy applied to each collection being traded.Reference: Kiosk Framework

TransferPolicy: Customisable and Enforceable Royalties

At the core of Sui’s Kiosk framework is the TransferPolicy, a customisable rule set that governs the trading and transfer of NFTs. The Royalty Rule within the policy specifies the fee due to the artist on each sale, ensuring consistent compensation. Meanwhile, additional rules—such as the Lock Rule and Personal Kiosk Rule—secure these royalties by requiring all transfers to pass through the TransferPolicy, preventing any unauthorised transfers or bypasses.Reference: Transfer Policy

Royalty Rule: Flexible Fee Structure for Creator Compensation

The Royalty Rule is designed to ensure that creators receive fair compensation on each sale through a flexible fee structure. This rule can be configured as a fixed amount, a percentage of the purchase price, or a combination of both—whichever results in a higher payment to the creator. This adaptable structure allows for various use cases, from straightforward commission fees to dynamic royalty models that adjust with the value of each resale.Reference: Royalty Rule

The Lock Rule: Securing NFTs in the Kiosk

The Lock Rule ensures that NFTs remain within the kiosk, enforcing a trade-only model. For an NFT to be purchased, it must be “locked” in the buyer’s kiosk, thereby respecting the TransferPolicy settings. This lock prevents any unauthorised removal of the NFT, ensuring royalties are paid on every transaction. Even though NFTs remain in the kiosk, they’re still accessible via borrowing functions, allowing the buyer to enjoy full usability without circumventing the artist's rights.Reference: Lock Rule

Personal Kiosk Rule: Preventing Unauthorised Transfers

To safeguard against unauthorised transfers that would bypass royalties, Sui uses the Personal Kiosk Rule. This rule ensures that only the verified owner can manage kiosk privileges by wrapping the KioskOwnerCap (the access control for the kiosk) within a PersonalKioskCap, which is a soulbound object. This means that malicious users cannot transfer kiosk ownership to avoid paying royalties, as the PersonalKioskCap is non-transferable. This additional layer prevents any attempt to bypass royalty payments, making each trade transparent and secure.Reference: Personal Kiosk

Reference: Personal Kiosk Rule

Comprehensive Royalty Protection for Artists

By implementing the Lock Rule and Personal Kiosk Rule, Sui creates a secure environment for artists to monetise their work. NFTs are traded exclusively through kiosks with enforced TransferPolicy rules, ensuring royalties are paid on each transaction. Users cannot simply move NFTs between kiosks or transfer the entire kiosk to sidestep royalty obligations. This framework empowers artists, allowing them to retain control over their royalties and depend less on marketplace policies, making Sui an ideal platform for creators to protect and benefit from their work fully.

Conclusion: A New Future for Artists

The digital landscape for artists is evolving, and blockchain is opening new avenues for creativity, ownership, and fair compensation. In this article, we examined how Sui’s cutting-edge infrastructure is redefining these possibilities. By embedding automated, on-chain royalty enforcement and flexible NFT standards, Sui empowers artists to control their work and earn sustainably.

Sui’s object-centric architecture, combined with its Kiosk framework, ensures that royalties are protected, bypassing the limitations of traditional marketplaces. This approach enables creators to confidently monetise their art, fostering a future where artists are central stakeholders in the digital economy. As blockchain technology advances, Sui stands out as a vital platform that prioritises and safeguards artistic value in the decentralised age.